An Open Letter to the New Government from AmCham

This letter identifies the eight most important initiatives we hope the new Government will accept are worth fighting for and making part of the government’s 2024 policy plan.

To the attention of: Prime Minister, Luc Frieden; Deputy Prime Minister and Minister of Foreign Affairs, Xavier Bettel; Minister of Finance, Gilles Roth; Minister of Economy and SMEs, Lex Delles; Minister of Education and Housing, Claude Meisch; Minister of Defense, Mobility and Equal opportunity, Yuriko Backes; Minister of Justice, Elisabeth Margue and President of the Chamber of Deputies, Claude Wiseler

Luxembourg, 11th of December 2023

Dear Excellencies,

AMCHAM Luxembourg (American Chamber of Commerce), on behalf of our constituency is sending this letter showing our support and confidence in the new government coalition, wishing you all full success and prosperity for Luxembourg and its people.

Now that your excellencies have come together in your new government, our constituents have reviewed the 12 topic groupings of your coalition agreement, and congratulate you on your agreed agenda.

Understanding the full execution of your program will not be easy, our most sincere hope is for your strength, commitment, and actions, to get the results the country needs. At the same time, our members have indicated they wish us to continue advocating for their action agenda. Therefore, by this letter we clarify that our community would respectfully like to see the new government enacting 10 suggestions into the national legislative agenda.

We kindly request you including the said 10 suggestions, among the wise positive actions you will take to achieve a more robust and successful economy and a more fair and inclusive society:

- Reduce the corporate tax rate from the present level of just under 25% to at least the EU average corporate tax rate of 21%. Obviously, it would be even better if you went even lower to 20%. We believe this action is vital to restore Luxembourg’s taxation attractiveness as a preferred corporate location thereby discouraging companies and people from leaving and encouraging others to come, invest and thrive in Luxembourg.

- Review to eliminate, simplify and uncomplicate policies and practices impacting residents and companies by reducing paperwork, costs, administrative burdens and their impacts.

- Empower and support legally existing Luxembourg ASBL charitable not-for-profit organizations to develop and manage government-subsidized micro-housing.

- Guarantee state banks issuing saving accounts and credit cards, on demand, to all legal residents of Luxembourg. Ensuring banking access will be highly appreciated by the new working population immediately upon arrival.

- Further upgrade the status of English as an official and legal Luxembourg language to aid new residents to assimilate more rapidly, reducing confusion and stress. As an additional benefit, an increased English language fluency will help young Luxembourgers be better prepared for employment opportunities within the global economy in this dominant global language.

- Adjust the current social security retirement policies allowing workers to voluntarily continue to work longer and contribute into the social security retirement system beyond age 65 if they have accumulated less than 30 years of social security retirement contributions in the Luxembourg system. Delaying retirement on a purely voluntary basis and allowing the accumulation of additional pension payment entitlements for those with less than 30 years of working contribution entitlement, will especially help foreigners who come into the Luxembourg system later in their lives. This step will pricelessly contribute for a higher quality of life by avoiding poverty in old age caused by insufficient levels of social security income.

- Adjust the current tripartite indexation policy to increase support for high performing younger employees eager to achieve prominent levels of career success and reduce the current impact of Indexation as a driver of inflation. The current practice as implemented leads to prices being increased simultaneously with the start of each indexation increase, thereby driving inflation as an unintended but unacceptable consequence. Likewise, mandatory indexation across the board for all employees at the same level, decimates the salary budgets of companies and eliminates funds which would be targeted towards rewarding high performing employees, most especially young people just starting their careers. We recommend the currently identified level of the gross indexation money pool be retained as at present, but only 60% of this amount be mandatorily allocated for distribution to all employees with the remaining 40 % earmarked for discretionary distribution to employees’ below senior executive level. We leave to the government to discourage companies from using indexation implementation as justification for companies to raise prices, but fully support the positive signal for tax authorities to adjust tax rates to ensure that indexation implementation does not increase tax revenue to the state by driving employees into higher tax brackets.

- Support education through increased subsidies and tax deductions. The education of all of our inhabitants, and most especially our young people is an initiative worth supporting for the long-range good of society both now and in the future. We would be pleased for the government to make tuition at primary private schools, at universities and lifelong learning fees allowable tax deductions. Additionally, considering parents are struggling and making significant sacrifices to send their children to the ISL, St Georges, and other private schools, we would appreciate if the government raises the level of subsidy for those students to a higher level (Currently this subsidy equals 40% of the cost of a student attending the Luxembourg public schools, which means that the state saves money off its own costs when compared to the costs if the state has to provide the education. While we very much appreciate the existence of a state private schooling subsidy, we believe doubling the current subsidy level to 80% of the cost of a public school’s student education would be a very supportive gesture to help companies recruit appropriate staff to come to Luxembourg and helping the staff to afford to live with their family members in our country).

Excellencies, we respectfully point out that our international community would very much question and object to the following two potential policy initiatives of the new government:

- Any form of increased taxation on companies or individuals including a national wealth tax, all of which we believe will make Luxembourg less attractive as a business location, and all of which we believe will reduce rather than increase governmental revenue.

- Any government-mandated reduction of the current 40-hour working week requirements, and we especially oppose any suggestions to consider any such changes while retaining current salary levels. We do not, however, oppose flexible working arrangements as agreed between individual employees and their employers.

Excellencies, we have presented a summary of our 10 suggestions. Our chamber will be delighted to present and further discuss these suggestions with your coalition and will happily respond to any for us to engage with you.

The people of Luxembourg have given a solid mandate to the CSV and the DP to work together in a more pro-business coalition which is motivated to create a smaller, harder working, more efficient, lower cost government, living prudently within its means via reduced and simplified bureaucratic processes, while being more user-friendly to individuals and companies at the same time. We fully support these objectives, wish your new government all success and a long life of service to the nation, the people, and the resident companies.

Please accept, Excellencies, the assurances of my and our highest consideration,

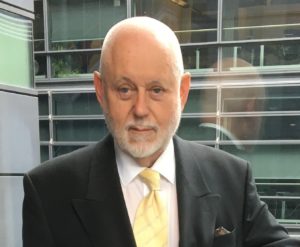

Paul Schonenberg

Chairman and CEO

AMCHAM.lu